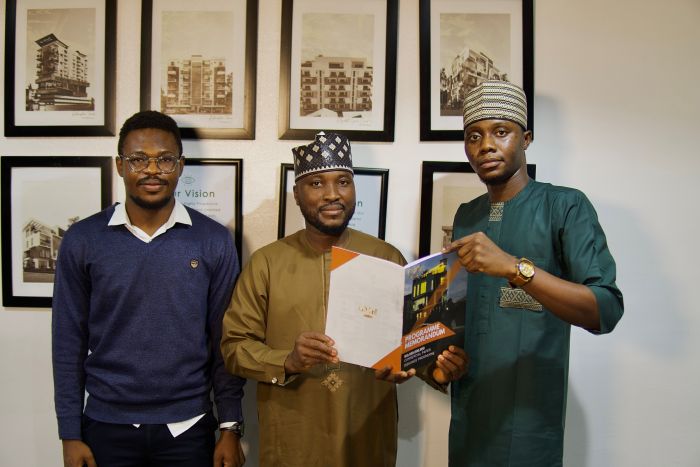

GestPoint unveils Cocoa RepubliQ, assures land buyers of good returns

GestPoint Limited, a real estate investment company, through its subsidiary, GestPoint Agro-Allied Limited, has perfected plans for agricultural estate development, which, it hopes, will be of benefit to the investing public.

The estate, known as Cocoa RepubliQ, was born out of expected future demand for food, agricultural exports, and foreign exchange. Prospective investors in this initiative can invest a minimum of N3million, and the developer assures they will reap multiple folds after three years.

“Going by Nigeria’s population, which currently exceeds 200 million and is projected to reach over 400 million by 2050, investment in the agriculture estate development anticipates massive future demand for food, agricultural exports, and foreign exchange,” Ebenezer Akinrinade, GestPoint’s managing director/ CEO, explained.

Akinrinade assured of bumper revenue, projecting annual revenue in the range of N5 million to N8 million, depending, however, on the number of acres owned, yield performance, global cocoa prices, and export market conditions.

He added that the revenue projection is supported by strong global cocoa demand and Nigeria’s position as a top cocoa exporter. “Nigeria is uniquely positioned to meet this demand due to fertile agricultural land, favourable climate, steady rainfall, and strong global demand for cocoa.

“However, many individuals who wish to invest in agriculture lack technical expertise; lack time for daily farm management, and seek trustworthy, structured platforms to deploy capital,” he noted.

Akinrinade disclosed that Cocoa RepubliQ was created to bridge this gap by connecting capital with professional farm management to deliver sustainable income and national impact,” he said.

He assured that the farm would be professionally managed by the company’s in-house cocoa farm experts, “each with over 13 years of hands-on experience in cocoa cultivation, plantation management, harvesting, and export readiness.”

“Currently, we are selling land at N3million at Abeokuta, Obafemi-Owode area. We are selling by the acre, not by the plot. One acre is N3 million. This is a pre-launch price. We are planting 400 cocoa seedlings on one acre of land. We have some experts who are supposed to nurture them for the next three years.

So, after three years, we are assuring all our investors that on this land, they will be earning N5million to N8million yearly, starting after the first three years,” he said.

This arrangement, he said, gives the assurance and guarantee that they will earn this income in another 25 years to 30 years, stressing that if someone invests N3 million, he will use it to buy one acre of land. Then, we plant cocoa for him and help him to nurture it.

On the security of the investment, he assured that the land is protected for farming activities and can sustain agricultural operations for over 20 years.

“Cocoa trees fruit for 25 to 30 years, aligning with the project’s long-term horizon. At the end of the cocoa production lifecycle, and subject to regional development and regulatory approvals, investors may collectively decide to replant cocoa for another cycle, or reclassify the land for residential or alternative use, depending on prevailing development dynamics. This provides both agricultural income security and future land-use optionality,” the CEO said.

Located in Shapala Village, Obafemi Owode LGA, Ogun State, an area officially designated for agricultural use, Cocoa RepubliQ sits on a total land area of 200 acres dedicated strictly to cocoa cultivation.

According to the company, the agriculture estate development is tailored for Nigerians in the diaspora seeking dollar-hedged, export-driven assets; agriculture enthusiasts seeking structured participation; remote workers and professionals seeking passive income, and high-net-worth individuals seeking asset diversification and capital preservation.

He revealed that the minimum entry requirement is one acre, but investors interested in acquiring multiple acres with no upper limit are subject to availability.

SENIOR ANALYST - REAL ESTATE

Join BusinessDay whatsapp Channel, to stay up to date

Community Reactions

AI-Powered Insights

Related Stories

SAHCO Strengthens Operation with Acquisition of Ultra-modern Equipment

Ezekwe Receives Excellence Award at UNIZIK AI Workshop

Tunde Lemo: How I Will Transform Ogun State Economy as Governor

Discussion (0)