FIRS sensitises, allays fear of Borno residents over tax reforms

…says new tax laws to boost investment, economy

The Federal Inland Revenue Service (FIRS) has said that Nigeria’s newly enacted tax laws are designed to enhance economic competitiveness, attract investment, and ensure long-term fiscal stability as stakeholders intensify efforts to deepen the public’s understanding of ongoing tax reforms.

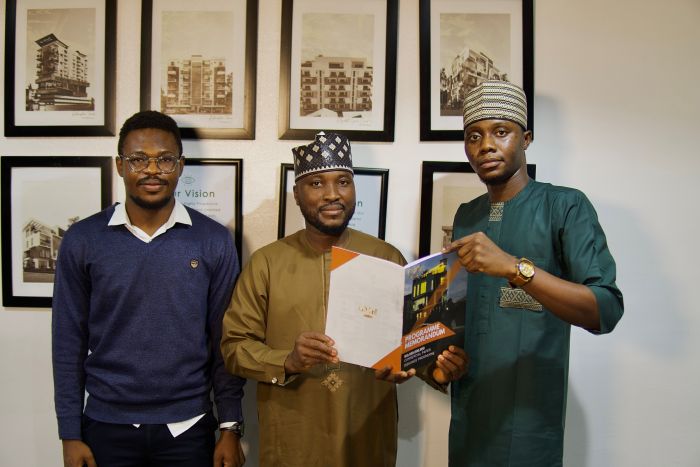

Speaking at the event recently, Adamu Isa, the FIRS Tax Controller, stated that the new tax regime offers several incentives aimed at easing compliance and encouraging investment, emphasising that informed engagement remains crucial to benefiting from the reforms.

The clarification was made at one-day dialogue organised by Centre for Advocacy and Transparency and Accountability Initiative CATAI in collaboration with ActionAid Nigeria on Strengthening Understanding of Tax Reforms for Inclusive Governance, themed ‘Youth, Tax Reform and Accountability: Building Informed Voices for Tax,”

Isa allayed the fears of Borno youths on the possible introduction of new taxes through proposed tax reforms and deductions of their money from bank accounts without their approval.

The FIRS boss noted that the new tax law would drive efficiency and modernisation, simplify tax laws, and ensure synergy among agencies involved, increase efficiency and effectiveness in Government savings, promote transparency and integrity in revenue collection, align with international standards, and broaden Nigeria’s tax base.

According to him, misconceptions about taxation often stem from inadequate information, noting that the reforms were designed to support taxpayers rather than burden them.

“There are many incentives for the taxpaying public to enjoy. What is important is to listen to the right people and get properly informed. When you take advantage of the incentives and comply with your tax obligations, there is nothing to be afraid of”, Isa said.

He urged Nigerians, particularly youths, to engage constructively with tax authorities, adding that voluntary compliance would strengthen public revenue and support sustainable national development.

Read also: If this tax law was altered, Nigeria’s Constitution has been breached

Also, Abubakar Sadiq Mu’azu, Executive Director of CATAI, stated that the workshop was convened to promote inclusive governance by strengthening civic engagement and enhancing citizens’ understanding of tax reforms.

Mu’azu explained that CATAI’s broader mandate includes enhancing service delivery, empowering communities and supporting democratic governance, especially in fragile and emergency settings.

He said the organisation works in partnership with Governments, communities, and global actors to create safe and inclusive environments, while delivering age-appropriate, disability-inclusive, and gender-transformative interventions for children, youths, and caregivers.

“Well as an NGO that we have been working in amplifying the voices of citizens, as well as complementing the government effort we have been studying throughout the process of this tax reform, to get to understand the merits of this tax reform, and we get to see that there are quiteseveralf merit to seeing how citizens can contribute in giving their own part by paying the tax and ensuring the decisions of utilization of such resources.

“Today, we are having this session in a way to advocate and also sensitize young people to serve as ambassadors of amplifying the reforms within this tax law by seeing that citizens pay their tax but most importantly, how these tax resources can be used to forms our budget spending, and we are collaborating with FIRS to see that we give the valid information to citizens out there to understand what are the merits of this tax reform and how it affects their life in terms of their basic needs within their communities.

“So there is nothing to panic. There is nothing to worry about. It is about how best they can pay their tax and how they can uphold their civic duty to ensure that public office holders judiciously utilise these resources for value addition across all our communities”, Abubakar said.

Join BusinessDay whatsapp Channel, to stay up to date

Community Reactions

AI-Powered Insights

Related Stories

SAHCO Strengthens Operation with Acquisition of Ultra-modern Equipment

Ezekwe Receives Excellence Award at UNIZIK AI Workshop

Tunde Lemo: How I Will Transform Ogun State Economy as Governor

Discussion (0)